Loan Settlement Lawyer in India

Loan Settlement Services | Credit Card Loan Settlement | Personal Loan Settlement | Vehicle Loan Settlement | Debt Settlement in India | Loan Restructuring Solutions | Reduce Loan Burden | Get Rid of Loan Harassment | Settle Loans Quickly | Loan Negotiation Experts

Are you struggling with loan repayment issues and searching for a reliable loan settlement lawyer in India? You’re not alone. According to the Reserve Bank of India (RBI), over 25% of loan applications in 2023 were either rejected or required restructuring due to credit issues. Many borrowers face harassment from recovery agents or end up paying unfair charges because they don’t know their rights.

This guide will help you understand:

What a loan settlement lawyer does

The legal provisions around debt settlement in India

How lawyers protect borrowers from harassment

The process of negotiating with banks and NBFCs

The best way to find a loan settlement lawyer in Delhi, Gurgaon, and across India

By the end, you’ll know exactly how to safeguard your finances and legal rights while settling your loan.

What is a Loan Settlement Lawyer?

A loan settlement lawyer is a legal professional who specializes in negotiating and resolving outstanding loans, credit card defaults, and personal/business debts between borrowers and lenders. Unlike debt consultants or recovery agents, lawyers work strictly under RBI guidelines and Indian laws.

Key roles of a loan settlement lawyer:

Negotiates settlement amount with the bank/NBFC.

Ensures settlement agreements are legally binding.

Protects borrowers against harassment by recovery agents.

Advises on credit score impact and future borrowing options.

👉 Example: If you owe ₹10 lakhs on a personal loan, a lawyer can negotiate with the bank for a one-time settlement (OTS) at ₹6–7 lakhs, ensuring legal closure.

Why Do You Need a Loan Settlement Lawyer?

Many borrowers ask, “Can’t I just talk to the bank myself?” The answer is yes, but without legal guidance you risk:

Signing unfair settlement terms

Facing harassment from collection agencies

Having your case escalated to Debt Recovery Tribunal (DRT) or court

Advantages of hiring a lawyer for loan settlement:

Lawyers understand RBI OTS policies and can negotiate better.

They ensure settlements are recorded in writing (legal closure).

They help avoid illegal recovery tactics by NBFCs or agents.

They protect your consumer rights under Indian law.

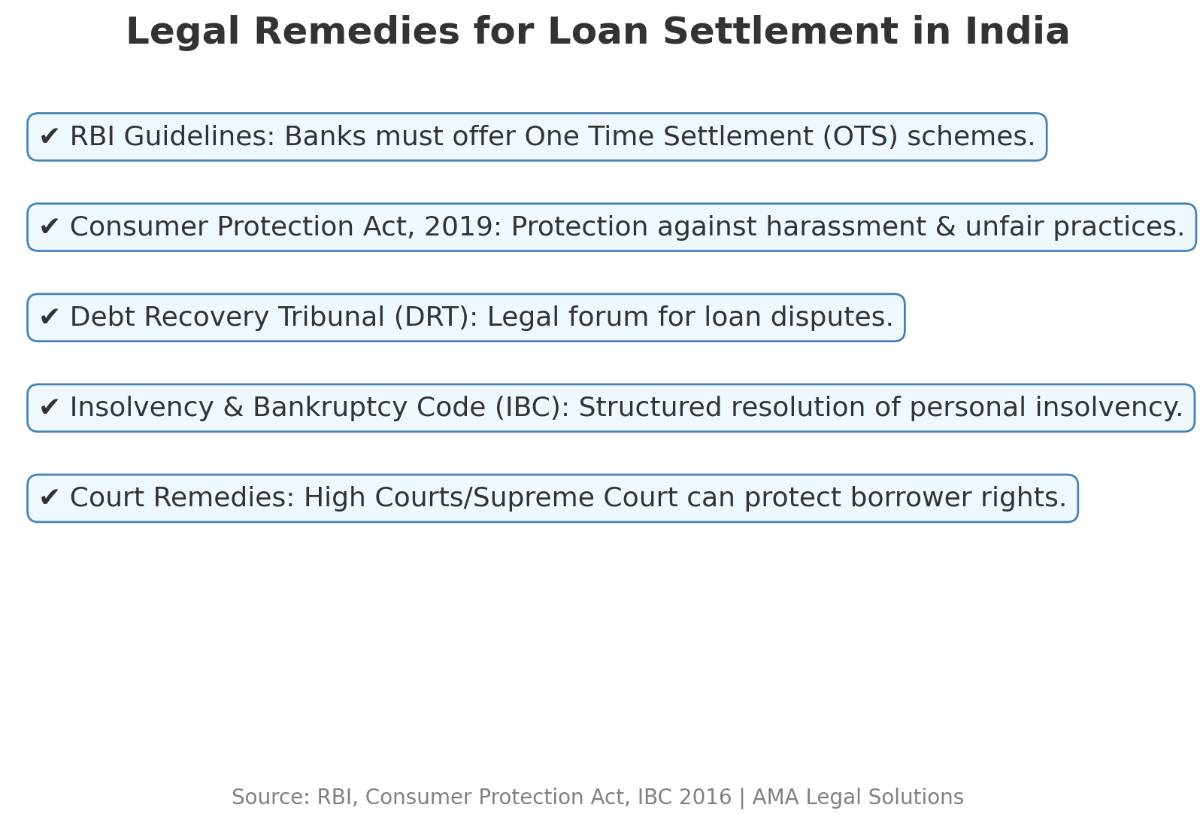

Legal Provisions for Loan Settlement in India

RBI Guidelines

RBI mandates that banks must follow One Time Settlement (OTS) policies for stressed accounts.

Borrowers have the right to written settlement terms.

Recovery agents must follow code of conduct – no harassment.

Consumer Protection Act, 2019

Loan-related disputes can be taken to Consumer Forums if banks act unfairly.

Borrowers can claim compensation for mental harassment.

Insolvency & Bankruptcy Code (IBC), 2016

Individuals and businesses can file for debt restructuring if unable to repay.

Key Benefits of Hiring a Loan Settlement Lawyer

Hiring a lawyer for loan settlement offers more than just negotiation:

Protection Against Harassment

Lawyers can legally stop recovery agents from visiting your home or workplace.Lower Settlement Amount

Skilled lawyers negotiate aggressively with banks/NBFCs to reduce outstanding dues.Legal Documentation

Lawyers ensure that once you pay, you get an official No Objection Certificate (NOC).CIBIL Score Improvement

With legal settlement and proper NOC, your CIBIL score can improve over time.

👉 Check our Legal Services for Loan Default and Settlement to see how we help clients nationwide.

Rights of Borrowers Under Indian Law

Even if you’re in default, you still have rights:

Right to Fair Treatment: Recovery agents cannot threaten, abuse, or harass you.

Right to Written Terms: Every loan settlement must be documented.

Right to Complain: RBI allows complaints against banks/NBFCs via the Banking Ombudsman.

Women Borrowers: Many banks offer relaxed repayment or settlement terms under special schemes.

Common Misuse & Limitations of Loan Settlement

Unfortunately, many borrowers fall victim to fraud:

Fake Loan Settlement Companies: They promise 70–80% waiver but disappear after charging fees.

Unregulated NBFCs: They may impose very high interest or illegal recovery charges.

CIBIL Impact: Even with legal settlement, your credit score takes a temporary hit.

👉 Always hire a licensed loan settlement lawyer instead of unregulated agencies.

Real Case Examples in India

Supreme Court (2016)

Held that “transparency in credit reporting is essential for fair lending practices”.

Delhi High Court (2021)

Directed TransUnion CIBIL to correct wrong reporting within 30 days when a borrower’s settlement wasn’t updated.

Bombay High Court (2022)

Ruled that banks must give written explanations for rejecting settlements.

Latest Trends & Legal Updates

RBI 2023 OTS Circular: Banks must have board-approved loan settlement policies.

NCRB 2023 Report: 25% rise in fraud by unregulated moneylenders, especially targeting low CIBIL borrowers.

Digital Lending Guidelines 2022: Protect borrowers from harassment by loan apps.

How to Choose the Best Loan Settlement Lawyer in India

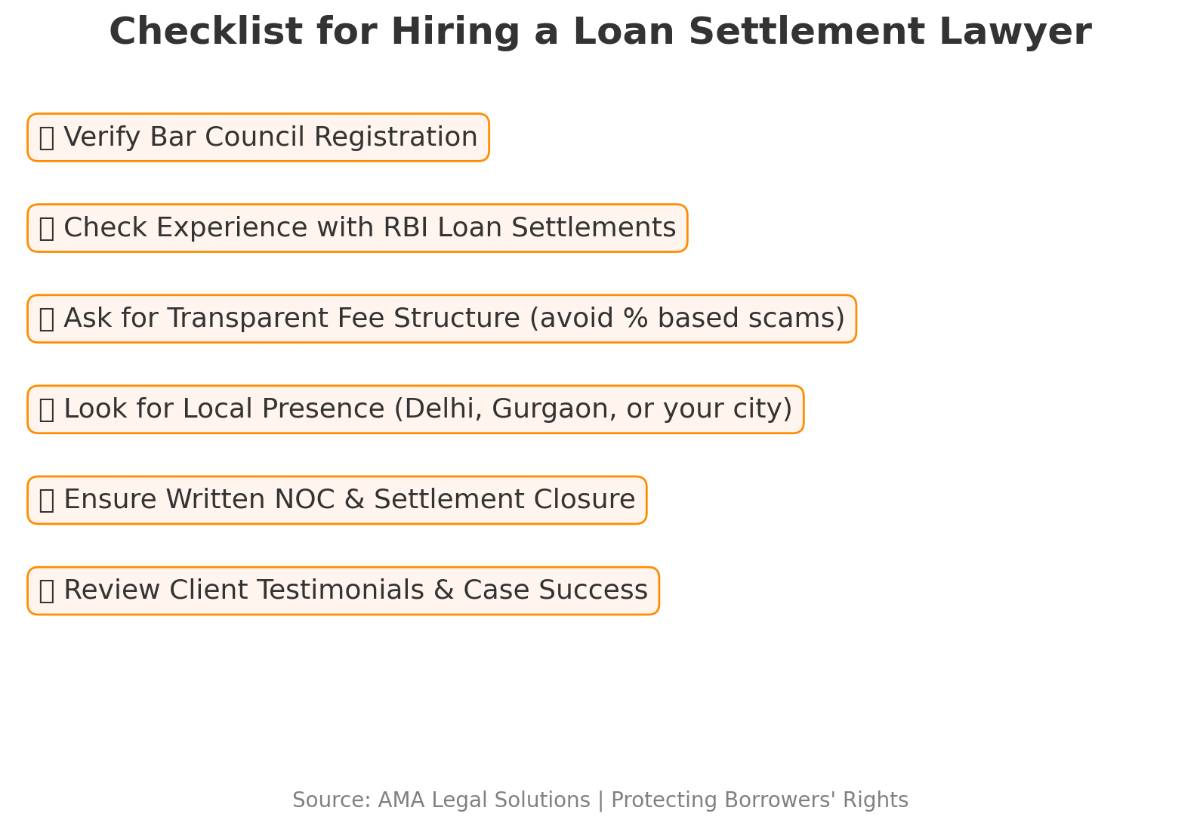

When searching for the best loan settlement lawyer, keep in mind:

Experience: Choose lawyers with proven settlement track records.

Local Presence: A Delhi or Gurgaon-based lawyer helps with in-person negotiations.

Transparency: Ask for clear fee structure (avoid percentage-based hidden charges).

Legal Registration: Verify the lawyer’s Bar Council enrollment.

Loan Settlement Lawyer in Delhi

Delhi is one of the cities with the highest cases of credit card defaults and personal loan disputes. Borrowers here often face aggressive recovery methods.

Why hire a loan settlement lawyer in Delhi?

To negotiate with big lenders like HDFC, ICICI, SBI, etc.

To protect against recovery agent harassment.

To represent you in case of DRT or court escalation.

👉 AMA Legal Solutions provides specialized loan settlement services in Delhi for both individuals and businesses.

Loan Settlement Lawyer in Gurgaon

Gurgaon, being a corporate hub, sees a surge in credit card and business loan defaults. Many young professionals face loan settlement issues.

Why a lawyer in Gurgaon makes sense:

Quick accessibility for in-person meetings.

Knowledge of local DRT and banking practices.

Protection against harassment in workplace and society.

📍 Visit us at Sector-57, Gurgaon for expert consultation.

A loan settlement lawyer is not just someone who negotiates your dues — they are your shield against harassment, unfair practices, and long-term financial harm. Whether you’re in Delhi, Gurgaon, or any other part of India, hiring a lawyer ensures your settlement is legal, transparent, and protects your rights.

💡 According to RBI, over 20% of borrowers improve their financial standing within 12 months after structured settlements.

👉 Need Help? Schedule a Free Legal Consultation with AMA Legal Solutions today and protect your future.

Frequently Asked Questions

Related Articles

Comprehensive Guide to Legal Services in Chanakyapuri

Explore top-notch legal solutions tailored for Chanakyapuri

Read Article

How to Boost Your CIBIL Score After Loan Settlement: 7 Tips

Essential strategies to enhance your CIBIL score post-loan settlement.

Read Article

Mastering Loan Collection Policies for Optimal Financial Health

Your Guide to Understanding Effective Loan Collection Strategies

Read ArticleAbout Author

Anuj Anand Malik

View ProfileAnuj Anand Malik, Founder of AMA Legal Solutions, is a trusted advocate, loan settlement expert, legal advisor, and banking lawyer. With over a decade of experience in loan settlement, corporate law, financial disputes, and compliance, he leads a result-driven law firm based in India that helps individuals, startups, and businesses achieve legal and financial stability.

Connect on LinkedInNeed Legal Help?

Get expert advice on loan settlement and debt relief.

Call +91-8700343611Request Callback